Penalties and Interest

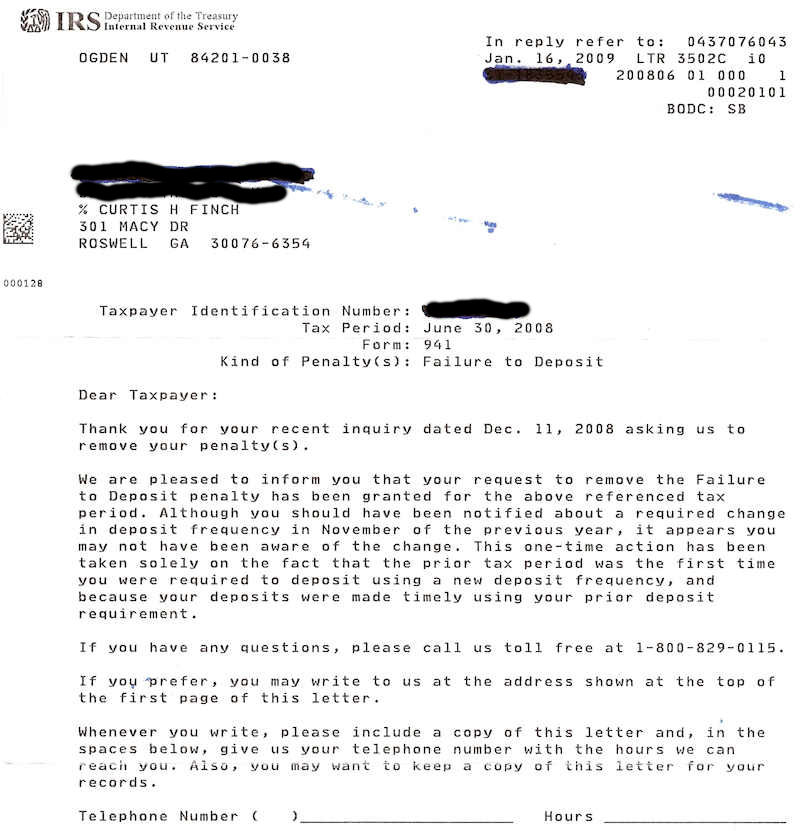

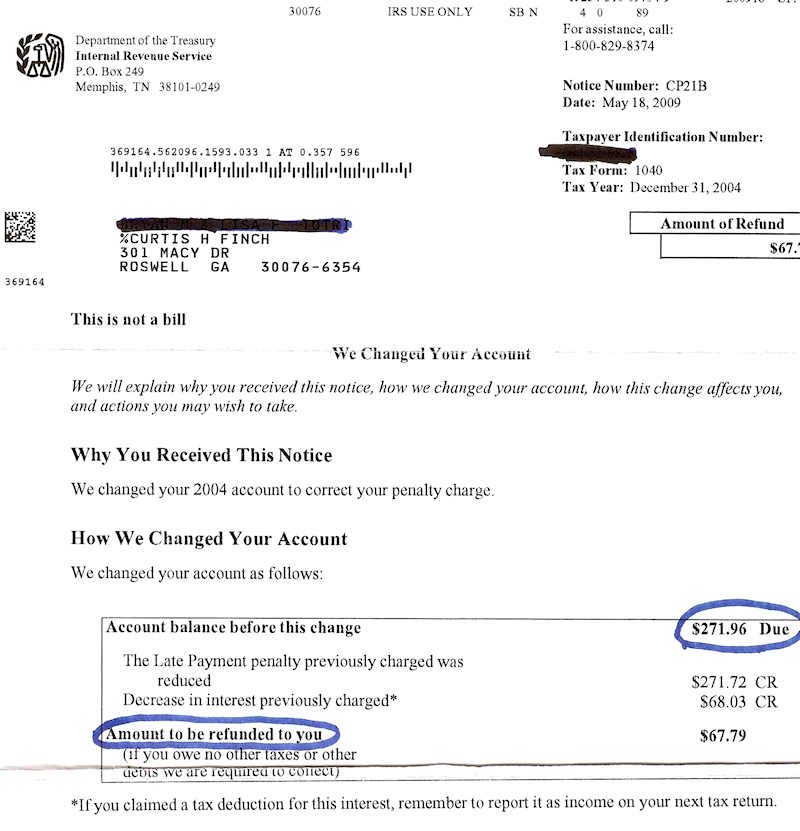

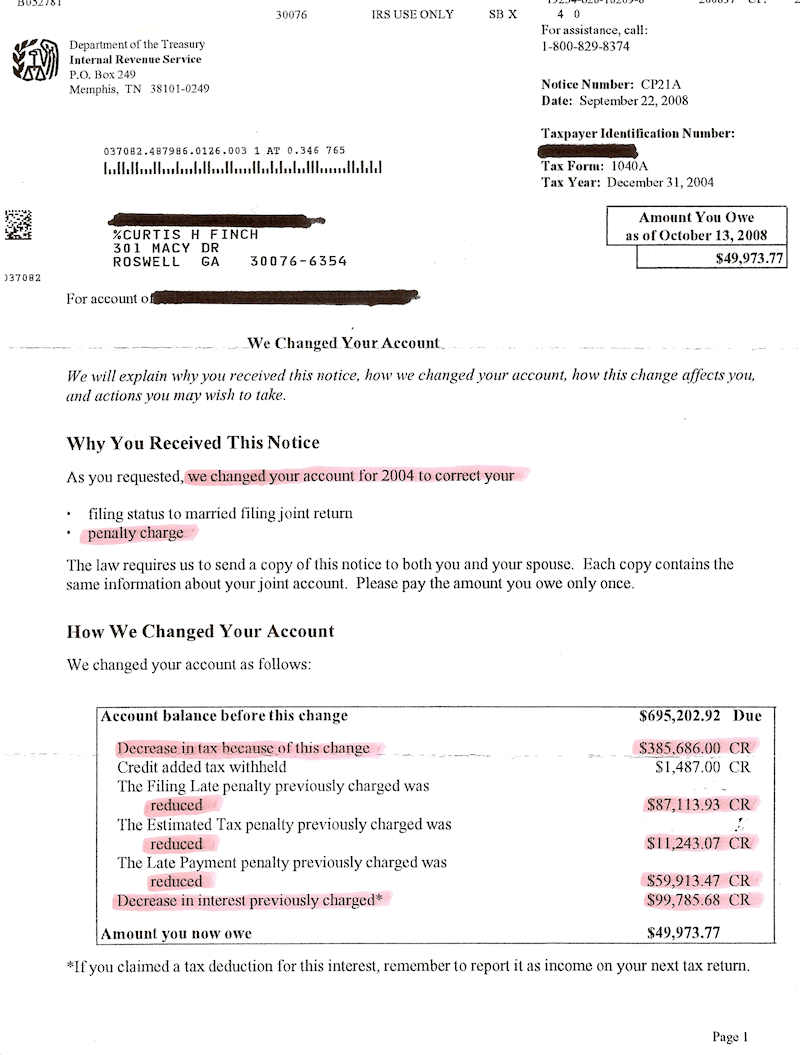

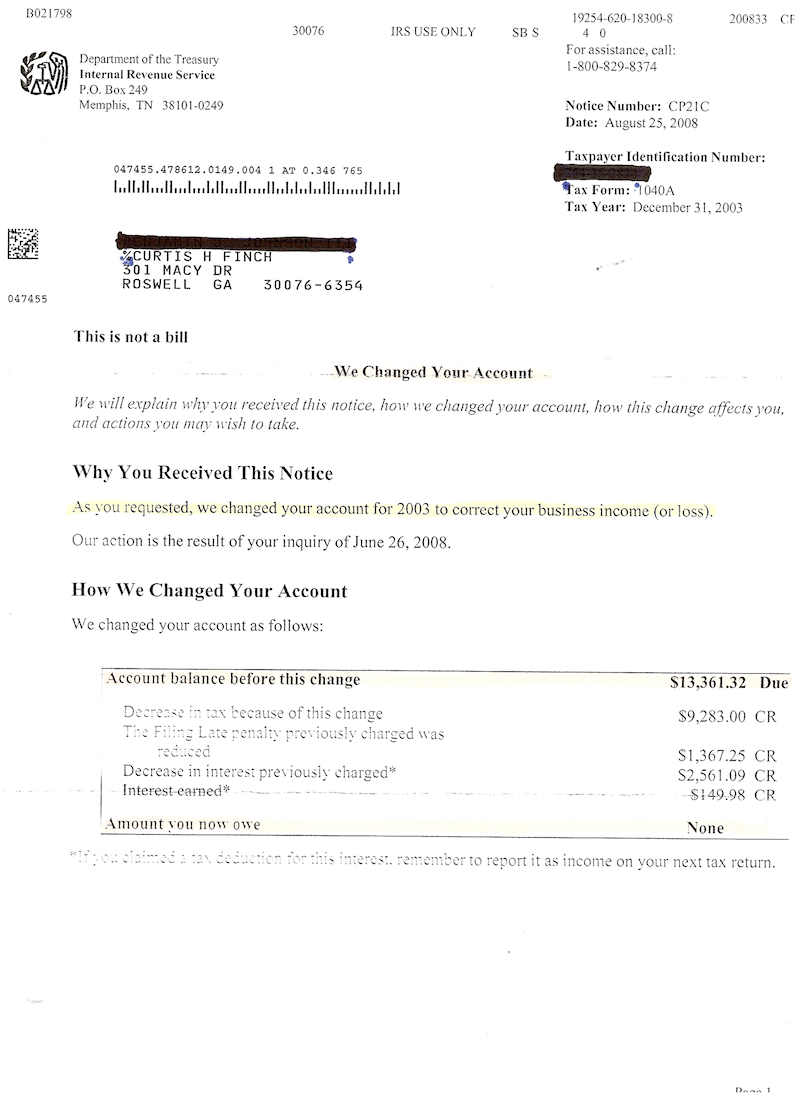

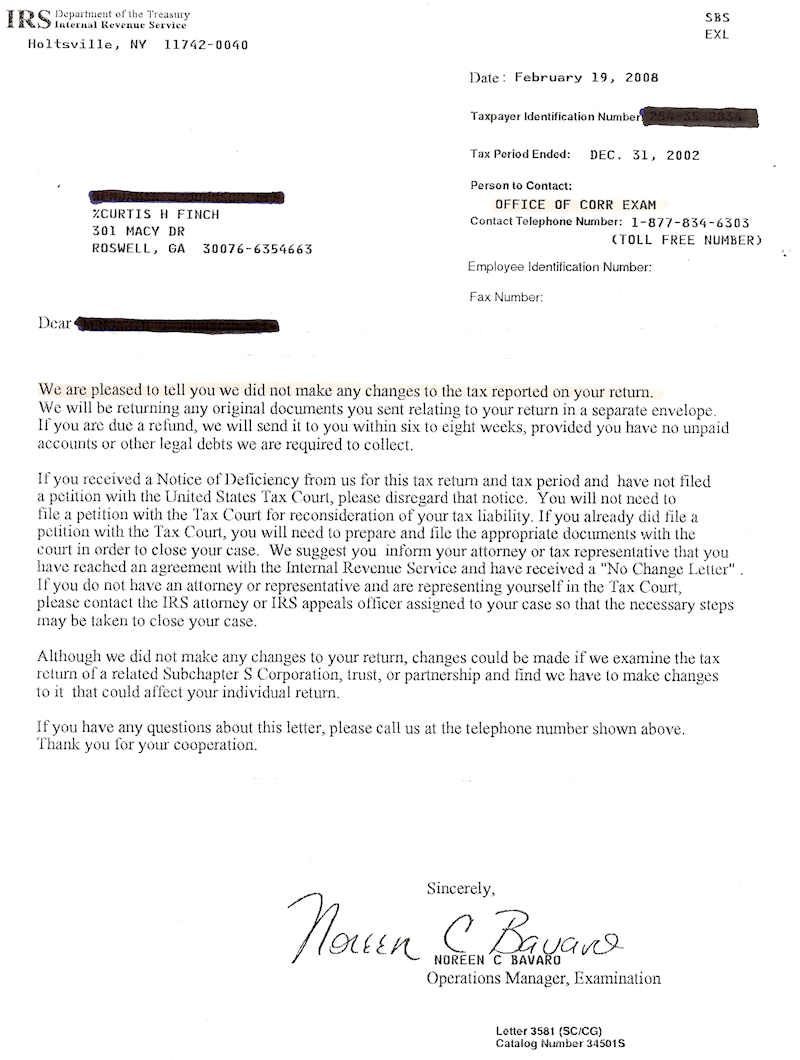

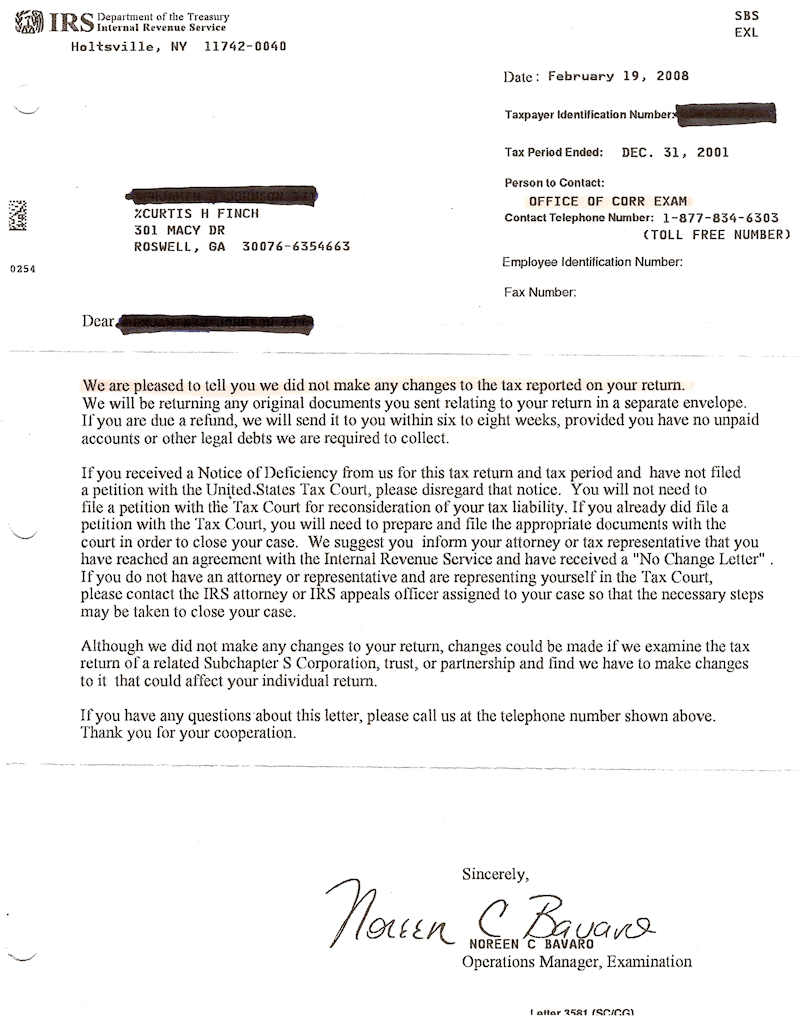

We've saved our clients thousands in taxes, penalties and interest

Each year, the IRS issues over thirty-four million penalties against individuals and businesses. Revenue from these assessments is often in excess of $15 billion. As a result, this is one of the largest sources of continuing frustration for citizens. Every year, the Taxpayer Advocate's Annual Report to Congress places penalties high on the list of the twenty most serious problems faced by citizens. A survey by the IRS of tax professionals shows that professionals consider penalties to be the fifth most serious problem faced by citizens. Fortunately, there is a simple and highly effective method of dealing with penalties. Unfortunately, the IRS does not often tell the truth about the procedure.

For those who have tax debts, it is no secret that the IRS will quickly asses penalties and late fees. The interest, though reasonable, still accumulates at a significant rate and can add to your overall liability and make it harder to pay the IRS back. If you have a large amount of back taxes, and the original balance was much lower than it is currently, penalty abatement may be a good option for you.

Interest Abatement

To make matters worse, interest on a tax bill often doubles, triples--even more--the debt. And this is one area where the IRS flat lies about one's right to deal with the problem. IRS publications declare that interest is always added and can never be canceled from a delinquent debt. While that is true in many cases, it is not a universal rule. There are several circumstances under which interest is legally subject to cancellation. Please see some of the examples where we have eliminated up to $100,000 in interest for a single client.

Penalty Abatement

Penalty abatement allows an individual to dispute interest and penalties for a certain period of time based on several reasons:

- Reasonable Cause - If you weren't aware fully of tax law code, had a death in the family, have a serious illness or weren't able to file, you would qualify for penalty abatement.

- Administrative Waivers- If you have had an unfortunate hardship like bad advice from a tax professional, natural disaster, death in the family, first time filing taxes, fixed income, mental diagnoses, lengthy unemployment, lost or destroyed financial records, drug or alcohol problems.

- IRS Error - If the IRS made a mistake on the processing of your claim or if the IRS gave you bad advice on how to file your taxes.

The IRS is coming after people and companies who owe back taxes with renewed vigor.

A Few Facts:

- The IRS has hired thousands of new employees, the majority working in collections and enforcement.

- The IRS has received huge budget increases, all to be spent on increased collection and enforcement actions.

- With these resources, the IRS expects to contact 800,000 more non-filers, increase the number of automated collection contacts, and close 160,000 more cases on under-reporters.

- The new IRS Commissioner has as his #1 priority to close the "tax gap" through stepped-up enforcement.

- The re-committed IRS will be driving business to tax problem resolution practitioners like never before; be ready for this unprecedented opportunity!

Here are More Convincing Facts:

- With a struggling economy, a growing deficit, and a war on terrorism to pay for, the days of the "kinder, gentler IRS" are over. The government needs money so they are funding the IRS to step up enforcement action!

- The IRS reports that over 6,000,000 taxpayers fail to file required income tax returns each year.

- IRS figures show it has 26.3 million active collection cases.

- The IRS has a new plan to comply with the congressional mandate to close the "tax gap". That plan will mean more enforcement actions than ever before.

- The IRS files thousands of federal tax liens each month, seizing bank accounts and other property and garnishing wages.

Please click on the examples below of how we have saved our clients thousands in taxes, penalties and interest. Contact us today to get the IRS off your back!